BRICS Currencies: Exploring Member Nations’ MoneyBRICS currencies and their profound impact on the global economic landscape are topics that everyone, from seasoned investors to curious global citizens, should definitely pay attention to. Hey guys, have you ever stopped to think about the sheer power and influence wielded by the BRICS group of nations? It’s not just a fancy acronym; it represents a formidable alliance of developing economies – originally Brazil, Russia, India, China, and South Africa – that have significantly reshaped international trade and finance. These countries collectively account for a substantial portion of the world’s population, land area, and economic output, making their individual currencies, and any potential moves towards a collective currency, incredibly important. Understanding the

BRICS currencies

isn’t just an academic exercise; it’s about grasping the dynamics of a multipolar world where economic power is diversifying rapidly. This article is your ultimate guide, diving deep into the individual currencies of these powerful nations, examining their strengths, weaknesses, and what makes them tick. We’ll explore the Brazilian Real, the Russian Ruble, the Indian Rupee, the Chinese Yuan, and the South African Rand, not just as abstract financial instruments but as reflections of their respective national economies, policies, and geopolitical standings. Beyond the original five, we’ll also cast an eye on the exciting developments regarding the

new BRICS members

and their currencies, recognizing that this bloc is continuously evolving and expanding its reach. From the bustling markets of São Paulo to the tech hubs of Bangalore, and from the industrial might of Beijing to the rich mineral veins of Johannesburg, the financial pulse of these nations beats through their currencies. We’ll also tackle the ambitious, often-debated concept of a

BRICS common currency

– is it a pipe dream or an inevitable future? So, buckle up, because we’re about to embark on an enlightening journey into the heart of global finance, unpacking the intricate world of BRICS currencies and why they matter so much to

you

and the global economy. By the end of this read, you’ll have a much clearer picture of these economic giants and the monetary systems that underpin their immense influence, giving you a competitive edge in understanding future global trends.## Who Are the BRICS Nations, Anyway?Alright, let’s kick things off by getting to know the

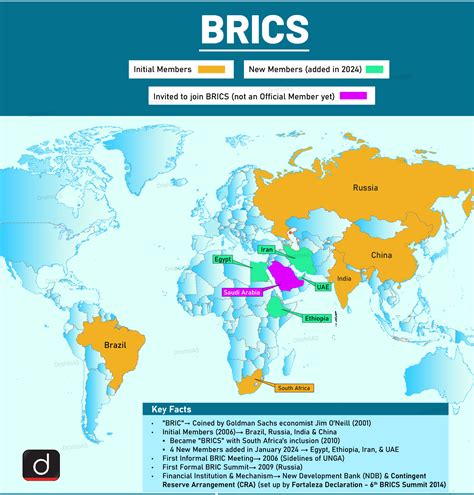

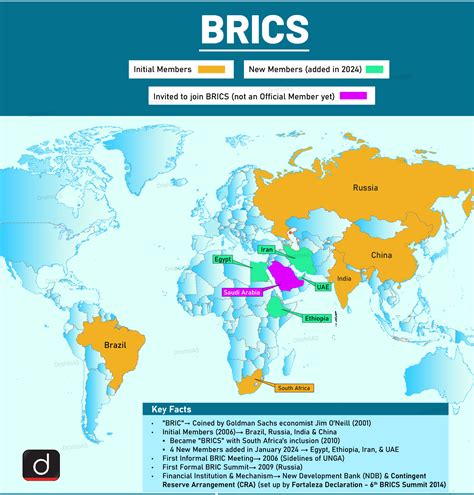

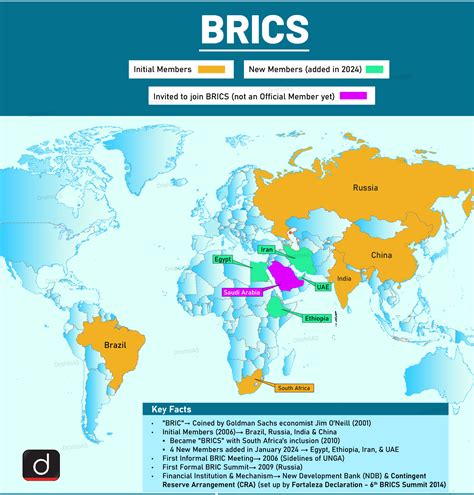

BRICS nations

a little better. You’ve heard the name, but do you really know who these guys are and why they’re such a big deal on the global stage? Originally coined by a Goldman Sachs economist in 2001, the term ‘BRIC’ (without the S) was an acronym for four rapidly developing economies –

Brazil, Russia, India, and China

– that were projected to collectively dominate the global economy by 2050. The idea was that these nations, with their large populations, vast territories, and significant natural resources, represented the future of economic growth outside the traditional G7 group. In 2010,

South Africa

officially joined the group, adding the ’S’ and cementing the bloc’s presence across four continents: South America, Europe/Asia, Asia, and Africa. Together, these original five BRICS countries represent over 40% of the world’s population and roughly a quarter of global GDP. That’s a massive slice of the pie, showing just how much economic weight they carry! Their collective voice has grown increasingly significant in international forums, advocating for a more multipolar world order and challenging the dominance of Western-led institutions. They’re not just economic powerhouses; they’re also major players in geopolitics, influencing everything from trade agreements to climate policies. What’s truly exciting, though, is that the BRICS bloc isn’t static. In a groundbreaking move,

BRICS expanded its membership

in early 2024 to include

Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates

. This expansion is a game-changer, increasing the bloc’s global reach and economic clout even further. With these new members, BRICS now accounts for an even larger share of the world’s population and significantly boosts its control over global energy resources, given the inclusion of major oil producers like Saudi Arabia, Iran, and the UAE. This expansion underscores the growing appeal and influence of the BRICS group, as more nations seek to align with a bloc that champions alternative models of global governance and economic cooperation. For anyone tracking international finance and politics, understanding the core tenets and the evolving composition of the BRICS nations is absolutely crucial. They are fundamentally reshaping how we think about global power and economic development, and their collective future is something worth watching closely. These nations are united by a desire for greater representation in global institutions and a push for more equitable economic development, making them a force to be reckoned with.## Deep Dive into BRICS CurrenciesNow, let’s get into the nitty-gritty of what makes the

individual BRICS currencies

tick. Each currency is a reflection of its nation’s unique economic structure, political landscape, and its position in the global trade network. Understanding these nuances is key to grasping the overall BRICS economic story. We’re talking about more than just exchange rates; we’re talking about the heartbeat of these economies!### Brazil: The Brazilian Real (BRL)First up, we’ve got Brazil and its currency, the

Brazilian Real (BRL)

. This currency has quite a story, reflecting Brazil’s journey as a major emerging market. Introduced in 1994 as part of an economic stabilization plan to combat hyperinflation, the Real literally brought order to chaos, becoming a symbol of economic stability for a time. Brazil is a colossal economy, the largest in Latin America, and it’s heavily reliant on commodity exports like iron ore, soybeans, and crude oil. This reliance means that the

value of the Real

often fluctuates significantly with global commodity prices. When commodity prices are high, Brazil’s export revenues increase, typically strengthening the Real. Conversely, a dip in global demand for these raw materials can put downward pressure on the currency. The

Central Bank of Brazil (BCB)

plays a crucial role in managing the Real. They frequently intervene in foreign exchange markets and adjust interest rates to control inflation and stabilize the currency. Inflation has been a persistent challenge for Brazil, and the BCB often employs aggressive monetary policies, including high-interest rates, to keep price increases in check. For investors, the Real can be an attractive currency due to Brazil’s high-interest rates, offering potentially higher returns, but it also comes with

significant volatility

and exposure to political and economic risks. Political instability, corruption scandals, and fiscal challenges have historically contributed to the Real’s rollercoaster ride. For example, during periods of domestic political turmoil, investors tend to pull capital out of the country, leading to a depreciation of the Real. Moreover, Brazil’s large public debt and the government’s ability to manage its fiscal accounts are always under scrutiny, impacting investor confidence and currency stability. Despite these challenges, Brazil remains a crucial player in global agriculture and natural resources, and its economy, though prone to boom-and-bust cycles, possesses remarkable resilience. The Real’s future largely depends on Brazil’s ability to diversify its economy, attract stable foreign direct investment, and maintain a consistent path of fiscal responsibility. Keeping an eye on global commodity trends and Brazil’s political climate is essential for anyone interested in the BRL.### Russia: The Russian Ruble (RUB)Next on our list is Russia and its currency, the

Russian Ruble (RUB)

. The Ruble’s trajectory has been nothing short of a fascinating, and often turbulent, ride, heavily influenced by Russia’s vast energy resources and its complex geopolitical standing. Russia is one of the world’s largest producers and exporters of oil and natural gas, making the

Ruble’s value

incredibly sensitive to global energy prices. When oil prices surge, the Ruble often strengthens, boosting Russia’s export revenues. Conversely, dips in energy prices can quickly lead to a weaker Ruble. However, the Ruble’s story isn’t just about oil; it’s also inextricably linked to international politics and sanctions. In recent years, particularly following geopolitical events, Russia has faced extensive economic sanctions from Western nations. These sanctions have profoundly impacted the Ruble, causing periods of significant depreciation and volatility. The

Central Bank of Russia (CBR)

has had to implement various measures to stabilize the currency and protect the financial system, including interest rate hikes, capital controls, and leveraging its substantial gold and foreign exchange reserves. Despite external pressures, Russia has demonstrated a remarkable ability to adapt. The government has focused on de-dollarization efforts, increasing trade in national currencies with friendly nations, and bolstering its domestic production capabilities. This strategic pivot has aimed to reduce the economy’s vulnerability to external shocks and sanctions. For instance, Russia has been actively promoting the use of the Ruble in energy trade with countries like China and India, seeking to bypass traditional payment systems dominated by the US dollar. This move is part of a broader strategy to assert greater economic sovereignty and build a more resilient financial infrastructure. While the Ruble remains a volatile currency due to its exposure to commodity markets and geopolitical risks, the CBR’s efforts to maintain stability and the government’s strategic economic adjustments highlight Russia’s determination to navigate a challenging international environment. Investors and analysts tracking the Ruble must constantly monitor global energy markets and geopolitical developments, as these factors remain the primary drivers of its performance. The Ruble, therefore, serves as a crucial barometer for understanding Russia’s economic health and its evolving role in the global financial system.### India: The Indian Rupee (INR)Moving eastward, we arrive at India, home to the

Indian Rupee (INR)

. The Rupee is the currency of a rapidly growing economic giant, a nation often hailed as the world’s fastest-growing major economy. India’s story is one of incredible demographic dividends, a booming technology sector, and a burgeoning middle class, all of which contribute to the

Rupee’s unique dynamics

. The

Reserve Bank of India (RBI)

plays a meticulous role in managing the Rupee, generally aiming for stability rather than extreme fluctuations. While the Rupee is not fully convertible on the capital account, meaning there are some restrictions on foreign investment flows, the RBI employs a